The Real Cost of Renewable Energy

Turns out “green energy” isn’t as “green” as one might think. The Wall Street Journal recently published an opinion piece by Mark Mills, a senior fellow at the Manhattan Institute, spotlighting the hidden costs associated with so-called “renewable” energy generation.

Mills points out an unfortunate reality for environmental activists: “wind and solar machines and batteries are built from nonrenewable materials. And they wear out. Old equipment must be decommissioned, generating millions of tons of waste.” Mills highlights a couple of particularly thought-provoking examples:

The International Renewable Energy Agency calculates that solar goals for 2050 consistent with the Paris Accords will result in old-panel disposal constituting more than double the tonnage of all today’s global plastic waste.

A single electric-car battery weighs about 1,000 pounds. Fabricating one requires digging up, moving and processing more than 500,000 pounds of raw materials somewhere on the planet. The alternative? Use gasoline and extract one-tenth as much total tonnage to deliver the same number of vehicle-miles over the battery’s seven-year life.

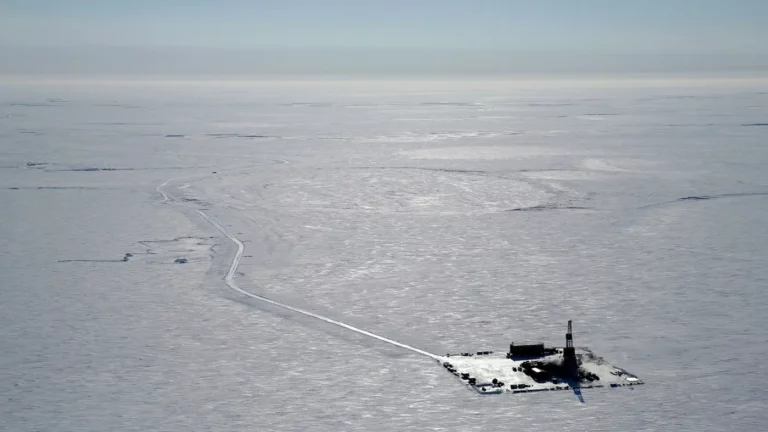

Electricity generated from wind or solar requires far more materials and land use than fossil fuels. As Mills points out, “a wind or solar farm stretching to the horizon can be replaced by a handful of gas-fired turbines, each no bigger than a tractor-trailer.” He goes further, writing:

Building one wind turbine requires 900 tons of steel, 2,500 tons of concrete and 45 tons of nonrecyclable plastic. Solar power requires even more cement, steel and glass—not to mention other metals. Global silver and indium mining will jump 250% and 1,200% respectively over the next couple of decades to provide the materials necessary to build the number of solar panels, the International Energy Agency forecasts. World demand for rare-earth elements—which aren’t rare but are rarely mined in America—will rise 300% to 1,000% by 2050 to meet the Paris green goals. If electric vehicles replace conventional cars, demand for cobalt and lithium, will rise more than 20-fold. That doesn’t count batteries to back up wind and solar grids.

The author notes that the demand for these minerals will likely take place in nations with oppressive labor practices – such as the Democratic Republic of the Congo, which produces 70% of the world’s raw cobalt, and will be refined in China. Mining and fabrication also requires the consumption of hydrocarbons – including billions of tons of coal and billions of barrels of oil.

These are important facts to consider when it comes to discussions regarding our nation’s energy portfolio. Activists have adopted largely unrealistic timelines to “eliminate fossil fuels” and often overlook the realities of affordable, reliable energy generation. Given these dynamics, timely investments in our nation’s energy infrastructure – the safest, most efficient way to transport a crucial supplier of electricity in the U.S. – simply make sense. As Mills concludes:

Engineers joke about discovering “unobtanium,” a magical energy-producing element that appears out of nowhere, requires no land, weighs nothing, and emits nothing. Absent the realization of that impossible dream, hydrocarbons remain a far better alternative than today’s green dreams.